Digital CAC Problem

With impending recession fears causing growth stage startups to tighten the belt, the problem of rising customer acquisition cost (CAC) and the overdependence on digital ads is growing more apparent. According to @chamath, $0.40 per $1 of venture capital raised by startups is spent on digital advertising on FB, Google and Amazon. Newly funded startups tasked with finding rapid growth have instinctively looked no further than digital ad platforms that take money and spit ROI faster than a slot machine. But when a long line of cash-flushed companies compete online for attention from the same niche customer, the cost per click steadily increases. This ultimately creates a vicious cycle where acquisition cost dwindles any actual margin while leaving the digital ad giants even larger.

The allure of digital ads especially for data-obsessed marketing teams is the quantifiable feedback. Ad platform dashboards that break down $X of spend into an observable Y% conversion rate create an intoxicating positive feedback cycle that rewards the short term gratification of naive ad strategies over other long term sustainable marketing strategies. Sure there are plenty of traditional offline channels (billboards, event promotions, swag giveaways, etc), but the problem is these channels are hard to reliably measure and therefore scale. Companies with larger experimental budgets will throw large $ sums of money at them, but that spend is still a minority chunk compared to the > 50% of marketing spend allocated to FB/Google ads. The trap with digital ads however is that over time, niche target audiences become saturated and all of a sudden a startup looking to scale finds itself spending higher CPM for a worse conversion rate.

The limitations of digital advertising long term forces startups today to think critically about organic distribution and sustainable marketing channels. The ideal marketing channel must not only offer wide reach and targeting of niche audiences but must be able to attribute and numerically report its own value (downstream conversion %) to justify spend. Granted it could reliably perform below the CPM for the average FB ad, such a service would be able to subsume the large marketing budget traditionally spent on those ads. This is why I’m relatively bullish on influencer marketing as a long-term channel (although not convinced there will be a scalable FB-style software-only influencer marketing platform to provide this). Companies like b8ta and Storefront are offering a return to offline brick-and-mortar stores but are equipped with data to track impressions/conversions that incentivizes brands to increase spend (their big insight is framing rent = CAC). I feel certain there are other similar opportunities to solve both the online conversion problem and the associated attribution problem that could potentially topple the digital ad monopolies.

What I’ve been consuming recently

Innovation Can’t Be Forced, But It Can Be Quashed

People Are Failing AP Tests Because Of The iPhone’s HEIC Format

Personal update

busy week. got to spend some time at the beach. so ready to reclaim this summer.

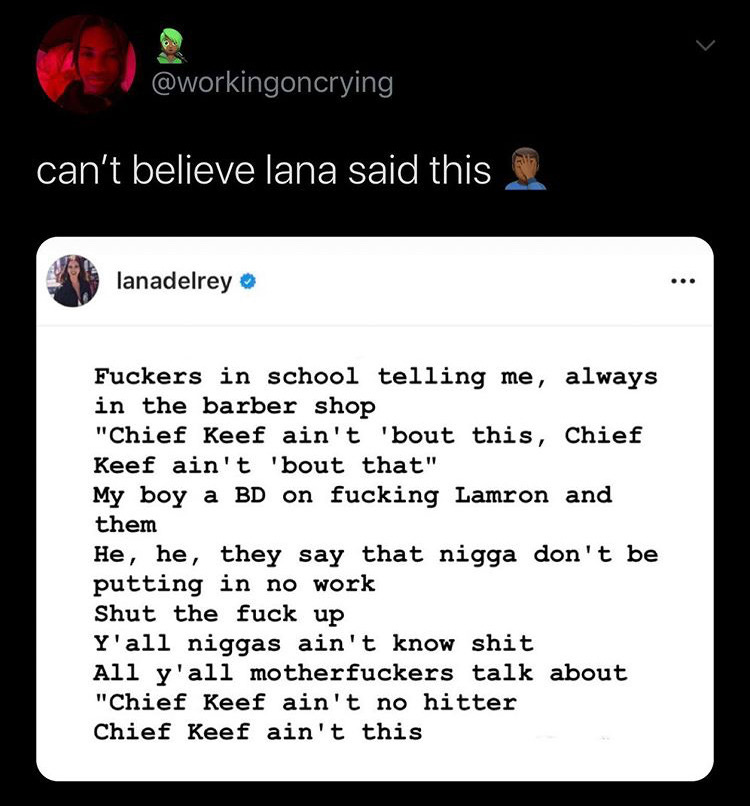

also lana is a kween